The CookCountyAssessor of Property is accountable for appraising the value of real property in the County Assessors use several criteria that help to set a price or worth of a property. The condition of the buildings and structures, the foundation and even the roof, the location of the structures, and other factors are all included. These factors are then compared with the sales price of similar properties in the area sold before the year the assessor made his or her assessment! If you are looking for a property, this is who you should reach out to.

The Cook County Assessor of Property makes his or her determination from information provided to him or her by sellers and buyers. The Assessor collects information about the structure, such as the foundation and roof, the location of the structure, and other information that pertain to the structure. The Assessor then analyzes the information provided to determine the value of the property. Know more about retirement plan options from voyaretirementplans.

On this page, you’ll learn about the following:

Guidelines for the CookCountyAssessment

If you own or lease Cook County assessor property, you should have your property assessed to ensure you are receiving the right amount of taxes. This information is often used by tax assessors and other local government entities in determining the value of homes and determining what they will charge for taxes. Learn everything about safe PC Checks from systemrequirementslab.

Your Cook County assessor property tax assessment information is important for a number of reasons. There are several areas where you will need to check your assessor’s information. Some of these are outlined below.

- The first thing that you will want to look at is your assessor’s property tax assessment information. This includes information about: your neighborhood, the homes in your neighborhood, your school district, the businesses in your neighborhood, and your overall property value. All of these things can affect the amount of taxes that you pay on your property. You should now be able to access your BankOfAmericaSignin account.

- The next thing you will want to check on your assessor’s information is your property’s current condition. This includes the total cost of repairs to your home. If there are any large repairs that you need to make to the home, these should be noted in your property’s report. It’s very important to check on any major repair needs before you sell your home. Get the latest clothes, shoes, and accessories from joesnewbalanceoutlet.

- Another thing that you should look at when you review your assessor property tax assessor’s reports is whether or not there are any liens on the property. These include mortgages, tax liens, and personal possessions. Any of these can affect how much money you are getting from your property taxes. Click here to unlock exclusive reading materials and resources from superteacherworksheets.

- Finally, you should always make sure that you check your property tax assessment information on a yearly basis. This is especially important if you plan on buying a new home in Cook County because property values change every year.

It’s important that you get the most out of your property taxes. When you pay attention to all of these important details, you will be able to receive the best value for your home.

What are CookCountyAssessments?

CookCountyAssessor tax assessments are based on the current value of the home that you want to buy. Because of this, the value that the assessor is providing you will be lower than the value that the seller is offering you.

- Your property tax assessor’s value is based on many factors, including the location of the home, the size and condition of the home, the number of rooms in the home, and the neighborhood’s crime rate. These factors can make a huge difference in how much money you will be getting paid from the county assessor. Click here to manage your medical accounts from unitedhealthcareonline.

- Keep in mind that your assessor’s value is not always the same. In fact, it can be drastically different from one year to the next. Therefore, you’ll have to look closely at your assessor’s report every year.

It’s important to note that your CookCountyAssessor tax is based on the current value of the home that you want to buy. Because of this, the value that the assessor is providing you will be lower than the value that the seller is offering you.

CookCountyAssessor tax assessments are based on the current value of the home that you want to buy. Because of this, the value that the assessor is providing you will be lower than the value that the seller is offering you. Value could change from year to year because there are many factors that affect how much you pay. Some of these factors include how much money your home was worth in the last year, the housing market in the area that you live in, and how many people moved into the area. Learn how Pearsonmylabandmastering has come up with all the perfect answers now!

First Look With the CookCountyAssessor

Before the sale of a property takes place, the CookCountyAssessor will look at the structure to see if it’s structurally sound. If it isn’t structurally sound, the seller may have to submit the necessary repairs before the property is placed up for sale. In addition, if there are any major issues with the structure, the buyer will have to fix them before placing the home on the market. Learn more about parking ticket options from citationprocessingcenter.

Once a structure is considered structurally sound, the Assessor will make his or her determination. From there, the Assessor will add or subtract the amount of money the property is worth from the sale price.

Factors of Assessment

The Assessor has several factors that go into determining the value of a property. One factor involves the condition of the structures themselves. Manage your bank accounts better by using exxonmobil.accountonline!

The structure is considered structurally sound when it hasn’t buckled under pressure. The structure also doesn’t need repair to be safe for use as a home. Any exterior or interior damage is also considered structurally sound.

- The next factor to consider when the Assessor determines the value of a property is the location of the structure. A structure is considered structurally sound if it is placed in a stable area. This includes an area that is built on a firm foundation.

- The Assessor’s Office has a number of tools available to assess the state of a structure. One tool is the Fire Protection System Index (FPI). This index shows the structural state of the home after an inspection of the roof, the walls, and any structural systems such as roofing, siding, and plumbing. Learn about auto loan services from wellsfargodealerservices today!

- There are a number of books available that have the information on how the values are determined, but there is no central book to use for all Assessors. You will find that the Cook County Assessor of Property uses the data in many different books and reports.

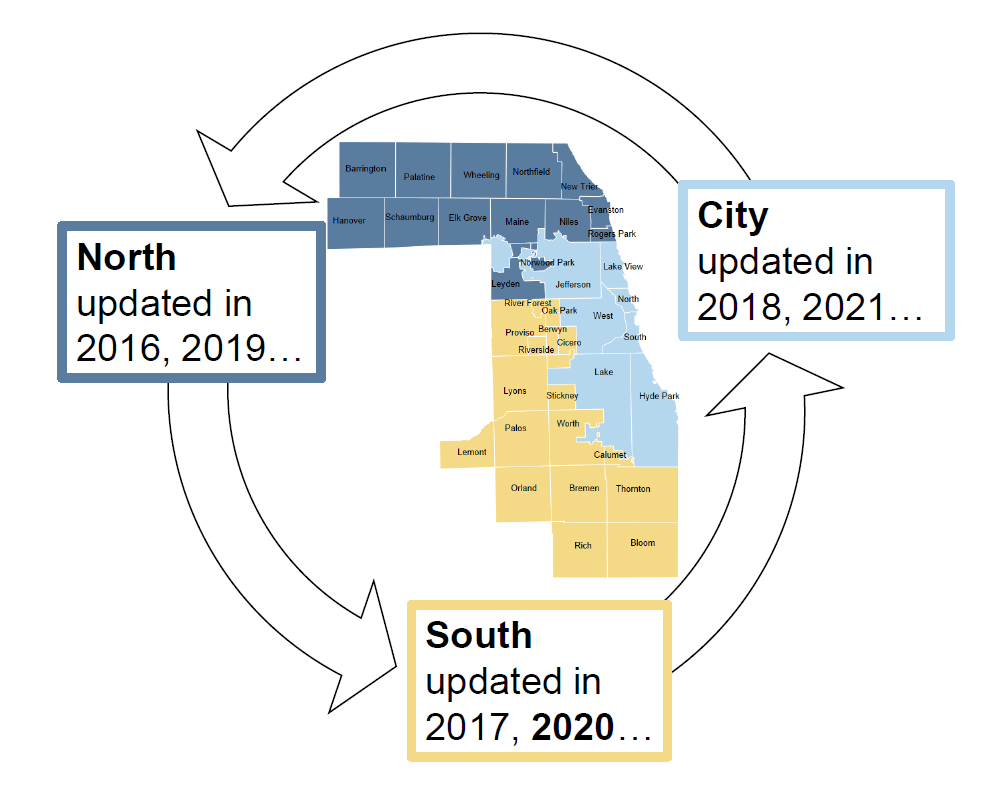

After any qualified property tax exemptions are deducted from the EAV, your local tax rate and levies will be applied to compute the dollar amount of your property taxes, and your Property Index Number (PIN) will be printed on your tax bill, your property closing documents and deed, and notices from the Assessor’s office (such as your assessment notice). Your reassessment notice also usually arrives once every three years after your township has been reassessed.

Conclusion

Before a property is sold, the CookCountyAssessor inspects the structure to ensure that it is structurally sound. In addition, the Assessor considers a list of publicly available publications and reports while making his or her decision. To find these volumes, contact the Assessor’s Office or conduct an online search. In addition to books and reports available to the public, the Assessor’s Office has an interactive website. On this page, the public can view their assessments using a variety of methods. You will be required to complete a single online evaluation form that covers all of the necessary information when you visit this page.

Eligibility applications are available in the incentives section. It is also their policy to provide everyone equal access to the remedies afforded by the appeal process.

You will receive a report that details how your home was assessed, including any necessary repairs needed. And the cost of those repairs. The Assessor then sends you a form to send in with your home to be inspected by a contractor. By using this site, you can obtain the same information that is available to the public when you contact the Assessor’s Office. The only difference is that you don’t have to take time to fill out forms. The results are delivered in a matter of minutes. You can ask about property details and eligible property, eligible properties, commercial properties, property tax savings, estimates of property values, installment property tax bill, property reassessments, or anything from the article.