Loanadministration.com/login or mortgage processing is a common practice, especially in big cities. However, this practice may also be necessary for other countries. Therefore, it is important to ensure that the client fully understands the loan processing process before signing any documents. The following are some important elements that should be addressed before a borrower signs a loan!

LoanAdministration processes require borrowers to send a completed mortgage application form to LoanAdministration. This process requires an initial quote of the loan amount and the date of the closing. Next, the quote is sent to the applicant, along with details of all applicable fees. When a lender receives the quote, they can then prepare to present it to the client and give him a written estimate on the total loan that has been requested. The client may also have the option to set up a telephone consultation with a representative from the lender. Click here to redeem coupons and watch movies with redeemdigitalmovie!

On this page, you’ll learn about the following:

How does LoanAdministrination work?

- Once the client agrees on the loan amount, the lender will send this information along with the terms and conditions of the loan and any fees.

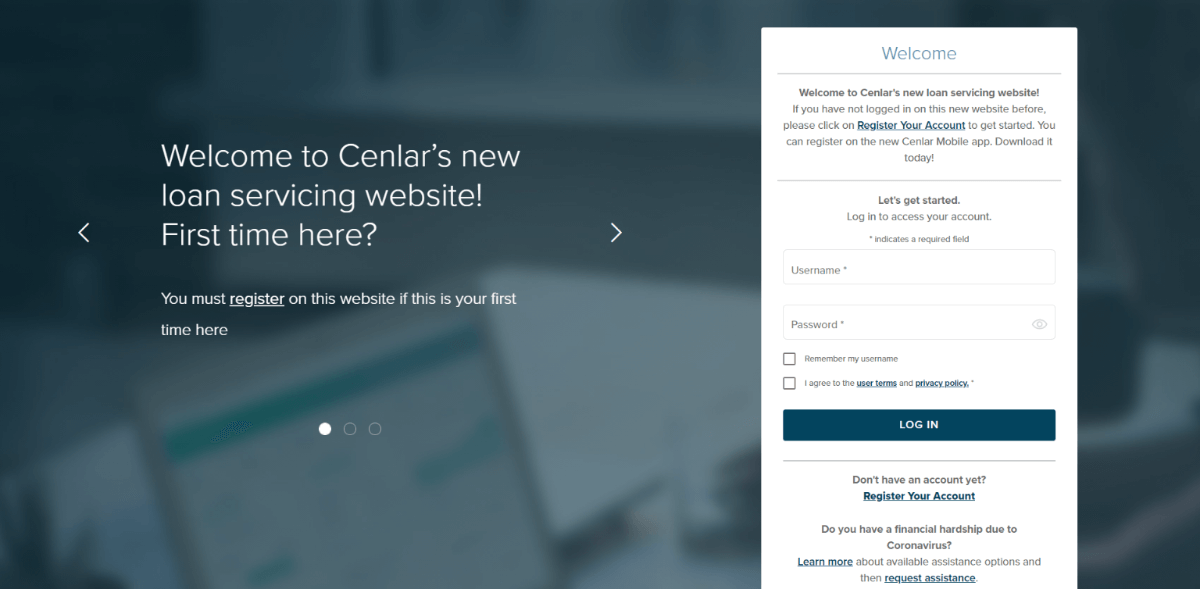

- The next step in this process is for the borrower to fill out an agreement with Loanadministration.com/login or Cenlar.

- This agreement contains a contract outlining what the lender expects in return for the loan amount and the due date for the loan.

- It should also outline any fees that may be charged, if any, and the borrower’s right to change his mind at any time during the contract period. So enjoy vacation experiences with my Disney experience today.

Upon signing the contract and agreement, the borrower is legally bound to pay back the loan.

- This is done in the short term, usually on the first anniversary of the date of the loan agreement. After that, however, the loan will continue monthly until the loan has been completely paid off.

- As part of the loan payment process, the lender will mail out a cheque on the agreed date. The borrower will need to sign this cheque to be presented as evidence of the loan amount. If the borrower is unable to prove the balance due, the lender will send another cheque.

How will the borrower contact LoanAdministrator?

LoanAdministration will then send the borrower an invoice for the amount of money received for the credit. This will be accompanied by a confirmation that details all the information provided on the original mortgage agreement. Get interesting quizzes for kids via multiplication.com by reading here.

- A document detailing the credit process and the repayment schedule will be attached to this invoice. The borrower may also choose to set up telephone consultation for the lender to discuss the repayment schedule further.

- If the borrower cannot meet the money or credit payments at the scheduled time, Loanadministration will send a letter to the borrower, allowing him to accept an extension.

- However, he will have to pay this extra fee, which is generally around $20. Failure to make the new payments will result in a default notice being sent.

How to finalize the loan?

As with any credit, there is always a final note attached to the credit. The note from Loanadministration will detail the reason for the note and the penalties charged if the borrower does not pay back the money on time. The note will also state the lender’s action should the borrower not repay the credit on the date set for the end of the note period. In addition, if the borrower fails to pay back the money in full, the lender may repossess the property on which the credit was obtained. Read here to get the extra fees for renewal at the twostepsonesticker.

- In most cases, once the money is paid off, the lender will return the money to the borrower through direct cash.

- This can occur through the lender returning the check from the bank, through the post office, or the recipient’s account.

- However, in some cases, the money may be deducted from the next paycheck by the lender to ensure that the borrower pays upfront. Find great American rented properties from americanhomes4rent right away!

- There are several reasons why credit may not be paid back on time.

- These include any defaults that occurred during the initial terms of the credit agreement, defaults due to fraud or deception, or any of the listed reasons listed in the credit documentation.

Conclusion

Loan Administration is one of the most important steps that borrowers should take when taking out credit. It should be done as soon as possible to avoid any issues that might arise in the future. The borrower must be aware of his/her rights before signing the document. By understanding them, the borrower will be able to make sure that the credit is repaid.