The day of our death is never known. Even accidents can occur when we least expect it. And if you are someone who has no money savings yet, it’s time you think about getting health insurance. HealthEArizonaPlus is an insurance policy that was recently introduced by The Arizona Plus Insurance Company. It is a value plan, which means that it is a type of insurance that gives the insurance carrier a percentage of your premium if you should become ill or injured as a result of their policy.

This kind of insurance is called value plans because it is a plan that is designed to pay out if you become sick or hurt due to another person’s negligence. You can be injured from anything from having your car stolen to losing your life while at work. Your insurance provider pays out on any claims of damages or loss that you incur due to being ill or injured as the result of someone else’s carelessness. You must read the fine print on your insurance policy to ensure that this type of insurance is worth the cost. Learn more about retirement plan options from voyaretirementplans.

On this page, you’ll learn about the following:

- 1 What exactly is HealthEArizonaPlus Insurance?

- 2 What is Premium Policy?

- 3 Important points about an Insurance Policy

- 4 How to choose a HealthEArizonaPlus insurance policy?

- 5 Who needs this HealthEArizonaPlus Plan?

- 6 Types of Insurance Coverage of HealthEArizonaPlus Plan

- 7 Different Types of Policies by HealthEArizonaPlus Plan

What exactly is HealthEArizonaPlus Insurance?

It is an online insurance policy for your body that is designed to cover the costs of medical care. There are many other things you should know about this insurance. However, here we will look at some of the key elements.

- The first thing to see when looking into Health-E-ArizonaPlus Insurance, and any other online insurance policy for that matter, is the term “insurance policy.” When you buy any insurance, it is typically referred to as an insurance policy. Next, learn everything about safe PC Checks from the system requirements lab.

- There are two main parts to an insurance policy: the policies themselves and the premium. The policies themselves cover a wide variety of different things. These include health, accident, life, and loss—all of these cover different aspects of your insurance policy.

What is Premium Policy?

When you buy a policy, you pay a certain amount each month based on the policy. This is known as a premium. If you don’t have any health problems, there is no need for a high premium. However, if you do have problems, you may need to make a little bit of extra money each month to cover your medical bills. You should now be able to access your BankOfAmericaSignin account.

If you are in the early stages of developing health problems, such as diabetes or asthma, you will have to pay a higher premium. This is because most health problems are expensive, and if you have them, you will have to pay out of your pocket to treat them.

Important points about an Insurance Policy

Another key part of an insurance policy is the policy itself. There are several different kinds of policies, which include whole life, term life, and universal. Whole life policies cover you for the lifetime of your policy, whereas term life covers you for only the life of the policy itself. Click here to unlock exclusive reading materials and resources from superteacherworksheets.

- Universal policies give you a choice between term and whole life insurance. Universal policies are cheaper, but they don’t cover as much. Whole life policies cover everything that a policy would cover you for under either term or universal.

- There are many ways to look at HealthEArizonaPlus. Take the time to do your research and learn all about the different policies. If you can’t find a policy that suits you, try to combine two policies to get the best possible coverage for your needs. Click here to manage your medical accounts from unitedhealthcareonline.

- If you are worried about whether or not you can afford your monthly premiums, it is a good idea to think about how much you would need to spend for a similar policy. A whole life policy would cost more than a universal policy, but it would be worth it if you could afford it.

How to choose a HealthEArizonaPlus insurance policy?

When choosing a health insurance policy, it’s important to consider your age, lifestyle, medical history, and risk of having a particular condition or illness. Insurance companies do a lot of research into these factors, and they base the rates on the information you provide.

- You might find that a group policy works better for you than an individual health insurance plan since you are probably already members of a club or organization and would need a specific type of insurance policy for that specific club. Learn how Pearsonmylabandmastering has come up with all the perfect answers now!

- Group plans have less coverage and cost more per month, but they are usually more affordable.

- When choosing a group plan, consider what is included in your plan. For example, if your employer or school provides health insurance, your group plan may not offer the benefits you need. Also, learn more about parking ticket options from citationprocessingcenter.

- Consider whether or not you can afford the high deductible that is required for a group plan. Many employers do not require a deductible, and if you are self-employed or a student, a group plan can be more affordable.

Who needs this HealthEArizonaPlus Plan?

Many people mistakenly think that value plans are available only to the elderly. This is not true. Even people who are in their forties and fifties can benefit from this kind of coverage.

Some people worry that they will be denied this type of insurance because they are in poor health or if they have an illness or ailment of their medical condition. However, if your claim is truly eligible, you can expect to get an insurance premium less than what you would pay under a traditional insurance plan. Manage your bank accounts better by using exxonmobil.accountonline!

Types of Insurance Coverage of HealthEArizonaPlus Plan

The HealthEArizonaPlus Insurances company is huge. The company is based in New Mexico. The individual policy is a smaller and more affordable plan. These are available for individuals with a small income and health problems.

They offer the following insurance plans:

- Health Maintenance Organization (HMO) – The Health Maintenance Organization is designed to provide health care through a large health care insurance plan. Although the HMO is great for those who can afford the monthly premiums, the disadvantage of HMOs is that the person using the plan is limited in the number of doctors’ visits allowed and in which he or she can see them. Therefore, it is recommended to use HMOs when possible. Learn about auto loan services from wellsfargodealerservices today!

- Also, you may qualify for “no-fault” coverage with The HealthEArizonaPlus Insurance Company as a form of value plan. For example, if your existing insurance company denies your claim and you file a claim through The HealthEArizonaPlus Insurance Company, then it can be considered as no-fault, and you may still be eligible for your insurance premiums.

- If your insurance company denies you, and you file a claim through The HealthEArizonaPlus Insurance Company, then it may still be considered as “no-fault,” and you may still be eligible for your insurance premiums. Get the latest clothes, shoes, and accessories from joesnewbalanceoutlet.

Different Types of Policies by HealthEArizonaPlus Plan

The HealthEArizonaPlus Insurance Company has some different types of policies to choose from. There are standard policies that protect for a year. Few policies offer additional benefits after the first year of the policy.

- There is an extended policy. This is where you can choose what type of benefits are available, like additional coverage for illnesses and accidents.

- Besides, you can add additional policies that provide “continued benefits” in the event of a claim.

- If you get injured and unable to work for one year, your insurance company will continue to pay the amount of your premium until you become able to work again or can be medically fit to return to work.

Conclusion

It is a type of online health insurance that is designed to cover the costs of medical treatment. There are numerous other aspects of this insurance that you should be aware of. Nutrition aid is provided by the Arizona Nutrition Assistance Programs (NA) SNAP. Many community partners also provide other services to those with low or no income.

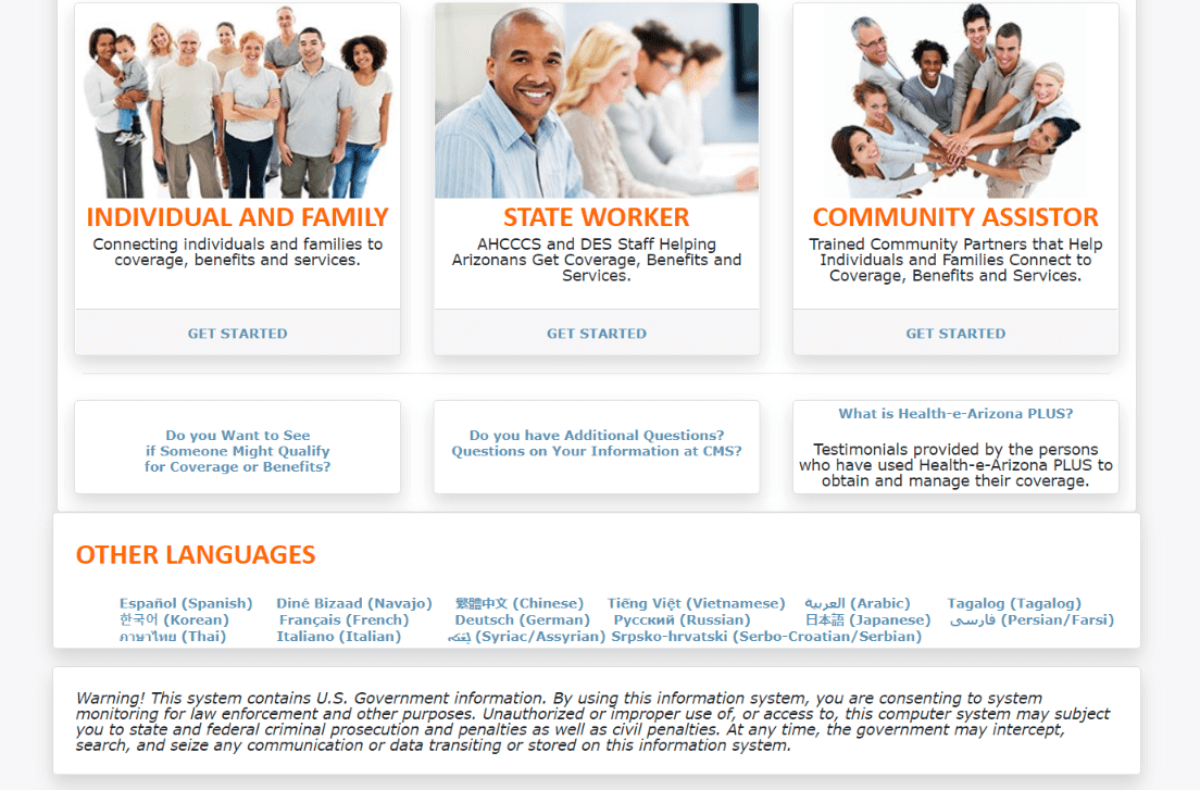

Organizations that are HEAplus Community Partners HEAplus is now used by over 200 Community Partner groups in Arizona to assist Arizonans in applying for AHCCCS Health Insurance, Nutrition Assistance (previously Food Stamps), and TANF Cash Assistance online.

Arizona Nutrition Assistance Programs (NA) SNAP provides nutrition assistance. Also, many community partners offer other services that help people with little or no income.

HEAplus Community Partner Organizations Today, there are over 200 Community Partner organizations throughout the state using HEAplus to help Arizonans apply online for AHCCCS Health Insurance, Nutrition Assistance (formerly Food Stamps), and TANF Cash Assistance.

Individuals and their families Individuals and families are connected to coverage, benefits like healthcare benefits, SNAP benefits, Government Benefits, and services. Even temporary support for eligible families, such as food assistance programmes for low-income families. With Health-e-Arizona Plus, you can submit the Health-e-Arizona Plus application for AHCCCS Health Insurance, Nutrition Assistance, and Cash Assistance.

Ask us about medical assistance, user application form or health insurance application process or anything from the article in the comment box below.

While this insurance is not guaranteed, you may get better terms and conditions for your insurance policy with The Health-E-Arizona Plus Insurance Company than you would get from an insurance company that provides “no-fault” coverage. With no fault, your insurance company is not obligated to provide you with medical benefits. If you have a medical condition that prevents you from returning to work after an accident, your insurance company can refuse to pay out on that claim!