YourMortgageOnline offers an extensive range of mortgages, including fixed-rate, variable-rate, adjustable-rate, and unique loan products, so that you can find a product that suits your needs. These are all backed up by some of the finest financial institutions and lenders in the UK and are designed to make sure that borrowers can get the best deal possible.

On this page, you’ll learn about the following:

About YourMortgageOnline & Their Mortgage Service

If you’re planning to get YourMortgageOnline, you should know all the details before you do it. It is essential to understand the different types of mortgages available and how they work and be aware of the various repayment options.

- You can choose to take either a single loan or a series of loans. A single loan will allow you to cover one single mortgage payment each month, so is ideal for borrowers with flexible budgets.

- However, if you have many debts or is planning to refinance, this may not be suitable. A series of loans are usually more useful if you plan to use them as a way of increasing your monthly income.

- Once you have decided which loan type you would like to use, you should get quotes from several lenders. The quotes you get will help you narrow down the range of options that you have and will ensure that you get the best deal possible.

- When comparing quotes, always think about the amount of the monthly repayments and consider the length of time you want to pay the loan off. You may also want to check whether you are eligible for any additional features, such as extra tax breaks or added insurance protection.

Also, read other articles on this site pearsonmylabandmastering, wellsfargodealerservices, exxonmobil: accountonline, citationprocessingcenter, unitedhealthcareonline, superteacherworksheets, and others.

Tips on Mortgage Applications at YourMortgageOnline

Before you apply for your loan, check the terms and conditions, and compare the cost of the loan. You may find that there is some hidden cost associated with your loan.

- Once you have filled out your online application and received your quotes, check the status of your mortgage loan, as it can take a number of days to process your details.

- If you find that you have found a suitable loan, make sure you repay it on time, as late repayments can lead to a penalty and can result in the lender reporting your late payments to the credit bureau. This is called a negative report and can damage your credit rating in the long run.

A quick tip for when you find your perfect mortgage is to compare the terms and conditions of different loans. You may find a better deal online, but if you are taking a loan that allows you to borrow more than your house’s value, you may get better rates when you borrow in cash.

Need for YourMortgageOnline Service

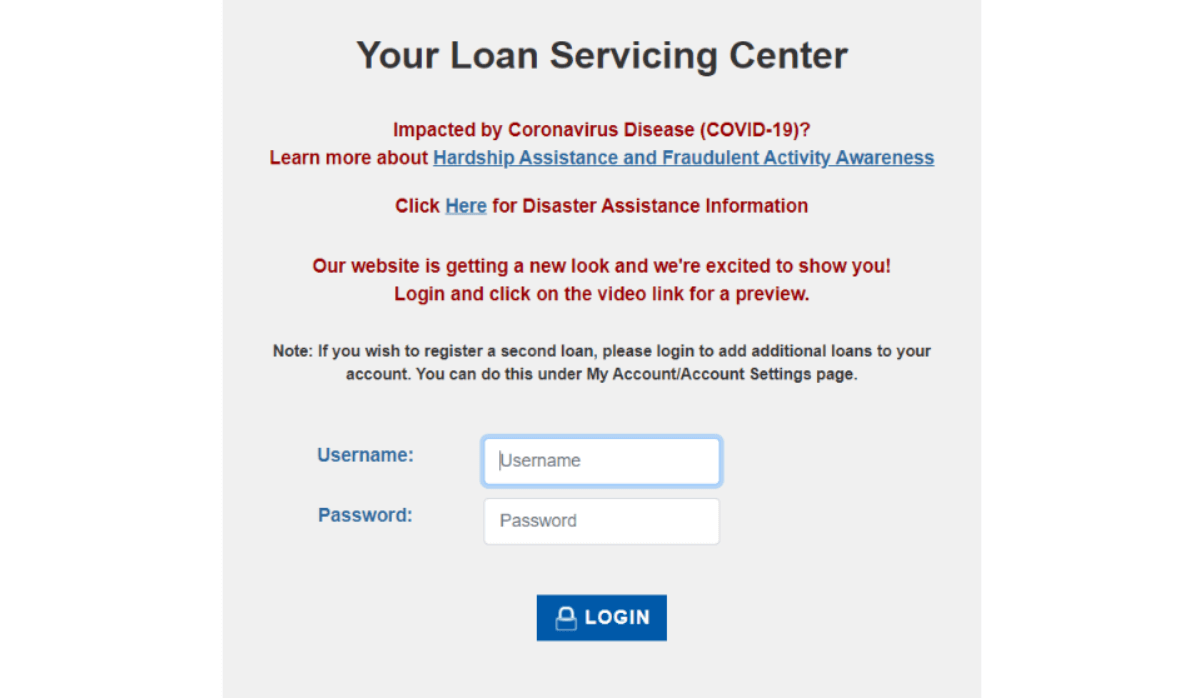

As said, YourMortgageOnline is an online portal that handles your loan accounts and account information. There are a bunch of benefits that YourMortgageOnline has. They are as follows:

- It is easy to access mortgage payments on a regular basis. Your monthly mortgage payments will be recorded and payment history is accessible from anywhere with this portal.

- With your unique loan number, you can easily register with the site. The portal is more of your personal mortgage servicer than anything else.

- You can make your monthly mortgage payments through the portal as it works as your savings account.

- They have a swift and accessible customer service department to handle all your issues related to real estate loans.

- It will be easier to remember your payment date with this portal’s payment system.

Conclusion

You will need to make sure that you regularly review your monthly payments to see if you can afford to keep up with the regular prices. Also, do bear in mind that interest-only repayment plans often involve a reduced amount to pay off in total, so make sure you calculate how much you need to pay off each month. Definitely, with YourMortgageOnline, it is much easier to do all these things.