If you consider a credit management business, you must look into LoanAdministration loan management services to keep the lending agencies happy. This article will discuss what these companies do and how you can benefit from this type of service.

These companies deal with all of the paperwork for credit and will do everything they can to get the best terms available for you. You will get to set your own interest rate and also be able to choose what type of collateral you want to have for your credit. You will be able to choose a good credit officer who knows what he or she is doing and has experience with the types of credits available for your particular business. Manage your driver’s registration process via cyberdriveillinois by clicking here.

On this page, you’ll learn about the following:

Why Choose Cenlar LoanAdministrator

Companies such as LoanAdministration have the ability to get your business to the point of success you have been dreaming about, and they can do so without you needing to be involved at all. These companies handle all of the paperwork for your credit. You may not even have to meet with them at all. Instead, they can handle all of the paperwork for you and get everything to your business quickly and efficiently.

The other aspect of LoanAdministration that many people may not know is that you do not have to sign anything for your loans if you do not feel comfortable with them. You can send them to the lender and let them know what you want. This is a huge advantage because it means that you don’t have to be concerned with making payments on your business loans. You can get to your business quickly without any concerns.

Benefits of LoanAdministrator

Many people are unsure if they can benefit from LoanAdministration. However, you can be sure that you will be able to use this service if you are having trouble making your payments on your loans. When you are struggling to make payments, it is not hard to lose money, which is why you need to stay on top of your finances.

- The LoanAdministration company will get you out of trouble when you are having problems. They will get you the help you need to stay out of financial trouble. In addition to this, you will be able to manage your business loan better. Plan future medical plans with wahealthplanfinder by clicking here now.

- LoanAdministration loan management can provide you with the loan management that you need to keep your business running smoothly and keep your credit standing strong. You will have access to the best possible loans for your business, and they will work hard to get the best possible terms for your business.

- When you hire a company such as LoanAdministration, you can feel assured that you are getting the best possible credit possible for your business. And they will get you out of trouble in the process. Click here to redeem coupons and watch movies with redeemdigitalmovie!

Save money with LoanAdministrator

Loan management will work to get you the best possible terms for your business. LoanAdministration will be able to work with your creditors to ensure that you get the best possible terms for your business credit. Get easy insurance medical plans from healthearizonaplus from this link.

- This means that your interest rates are low, and your payments are affordable. In addition, LoanAdministration is very experienced in this area, and they can negotiate the best deals for you.

- You will save money on your business since you will no longer have to pay your loans on your own.

- However, you will still have to make sure that you have enough capital left in your business to keep it going. Get help with your taxes through cookcountyassessor. Click here now.

- If you have a large amount of debt, you may have to turn to your business lender for extra money to pay off your business debts.

- If you have a small debt, you can usually get by without borrowing any money from your lender.

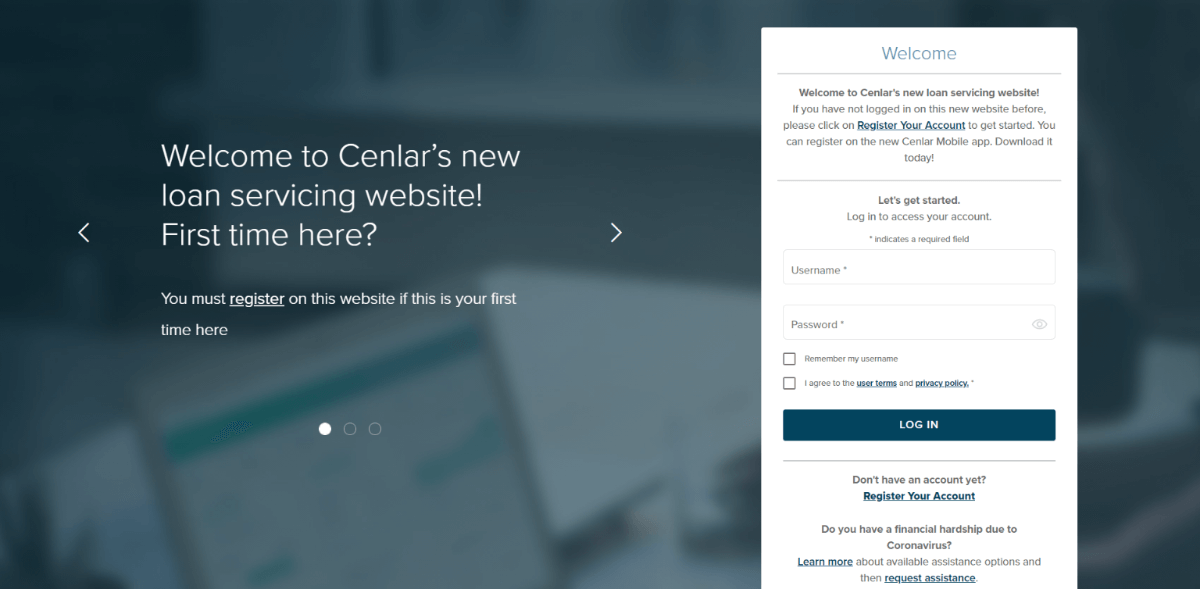

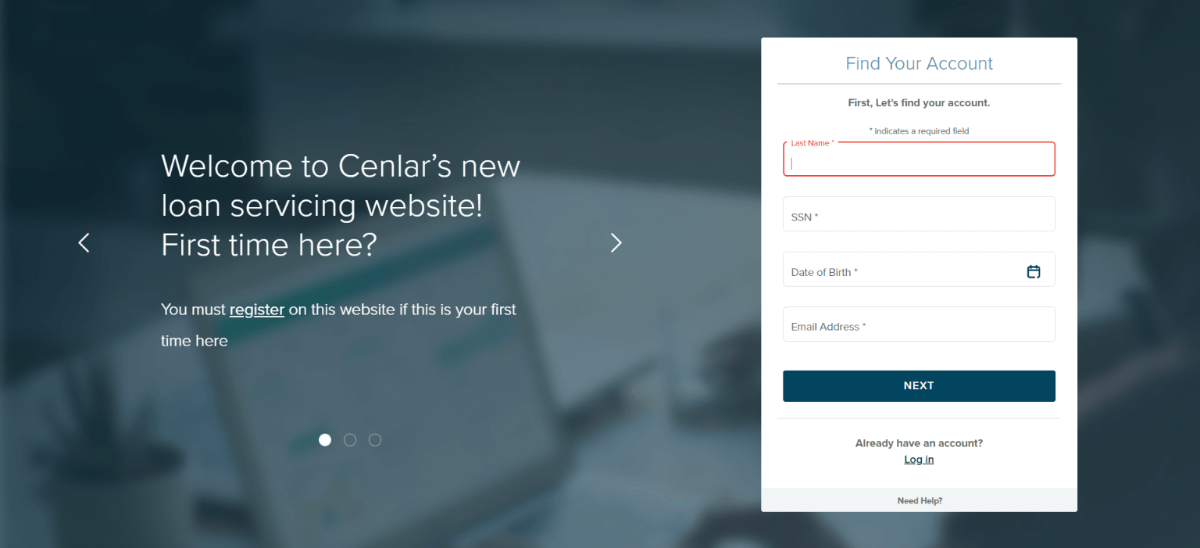

Note: center FSB Attn Cenlar / Cenlar FSB ATTN, the nation’s leading credit servicing provider, has been actively engaged in mortgage servicing and sub-servicing as a core business for more than 40 years.

Conclusion

If you need more information about how you can benefit from LoanAdministration, talk to a LoanAdministration LoanAdministration company about your loans. They can help you with more information and help you learn about the options you have to help you out with your loans.

A loan management company can offer you all of the answers you need when you need to learn more about how you can manage your business’s finances. You can learn more about LoanAdministration loan management and how you can get out of trouble.

Ask us about the government agency, insurance policy, mortgage loan servicing, insurance claim package, insurance premiums, insurance provider, Private Mortgage Insurance, loan servicer, loan servicing provider, property taxes, delinquent tax notice, Notice of Transfer, conventional loans, loan servicing center, mortgage loan originator or anything from the article in the comment box below!