If you are a credit card holder, then you should know about MyCardStatement. It is an online portal especially designed for credit card users and makes their lives easier to a great length. One of the primary benefits of MyCardStatement is that the portal can be accessed easily from any electronic device as long as it has an active internet connection. This feature makes it usable among both the older population as well as, the younger.

However, before we delve into the details of MyCardStatement, you can take a look at NorthShoreConnect and quickpayportal to maintain your health well.

On this page, you’ll learn about the following:

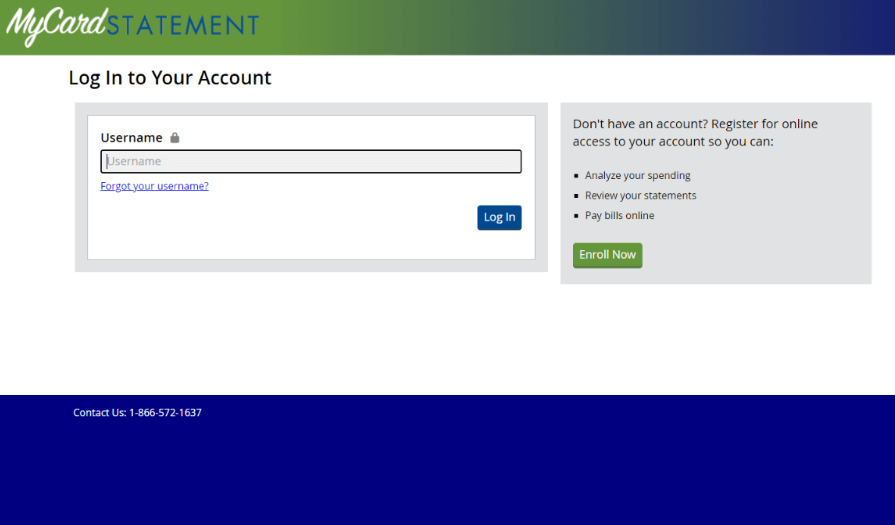

Logging into MyCardStatement

The login procedure of MyCardStatement consists of a few steps. To log in to the account, you need to register yourself first. For help in that regard, you can look at the article Mycardstatement.com that deals with the registration process on the portal in detail. After you have registered yourself on the portal, you will need to:

- Visit the official website of MyCardStatement from your laptop or smartphone.

- Once you are on the portal, you will have to click on the button that says ‘login’ and provide the necessary information.

- After filling out the required information, you need to click on ‘login.’ If your provided details are correct, you will be taken to the homepage of your MyCardStatement account.

Once you have logged in to your account, you will be able to avail all the site offers and have a smoother grasp of your financial life.

Benefits of Logging in to MyCardStatement

Keeping yourself logged into your MyCardStatement account will help you in multiple ways. However, before getting to know about them, you can look at Northshoreconnect.org/signup or myfloridacounty available on this site to understand better the process of signing up on online portals.

Also Read indianacareerconnect, planningcenteronline, myfirstpremiercard, icanhascheezburger, mycrickethighlights, and other articles on this site.

Benefits of Staying Logged in to MyCardStatement

- You will remain up-to-date regarding all your current and pending transactions.

- You will be able to check your electronic invoice at frequent intervals and without any hassle.

- You will also be able to check your financial statements whenever you would want to.

- Being logged into MyCardStatement will help you to manage your individual and company finances easily.

- You will track the number of financial transactions that you have made from your accounts—even your credit limit.

What is MyCardStatement Login Portal Statement?

The login portal statement of MyCardStatement is the summary of all your monthly transactions that come in the form of an invoice. It is important for credit card issuers to send the credit card owners a statement of their monthly transactions at least 21 days before the date of expiry. The statement is generally shipped by mail, but if one has opted for electronic billing, they should ensure that they are registered online with the credit card company.

Perks of Using MyCardStatement

MyCardStatement can change your financial life. If you have any doubts about what it can do for you, let me clear it up. Unfortunately, not many people know this, but with the new MyCardStatement, your card can be used for just about anything. The best part is that you don’t even have to worry about being swiped at ATMs to get a cash advance.

This is one of the most important ways that MyCardStatement can change your financial life. But, unfortunately, by paying monthly fees on your credit cards and not paying them off every month, you are setting yourself up to be more susceptible to identity theft.

- These statements will show you everything that’s owed on your credit card bills. This includes those that are past due and those that are late.

- You can do the next thing with your monthly statement to send an email to your account receivables. This is an account where you send your bills because they will not send the bill to you.

This will ensure that you get the bill for your invoices immediately. If you have a large bill, you can get it printed and then mail it out and make sure to make your monthly payments.

Another thing that you can do with your monthly statements is to put a few checks in a box and put a separate check-in for each account. This will allow you to track the status of all of your accounts. For example, you will know if you have been over the limit on your cards.

Making Monthly Payments on Time

The only way that you are going to be able to make your monthly credit card payments on time is if you pay your balances in full each month. However, most people don’t bother because they think that they can do that at a later time. That’s where MyCardStatement comes in. With this card, you can actually go to the website, download your monthly statements, and print them out.

Read more about other similar services indianacareerconnect.com/register, Myhealthatvanderbilt.com/signup, firstpremier.com/myfirstpremiercard, icanhas.cheezburger.com, and other articles on this site.

Monitoring Credit Reports

You can also make sure that your credit is at its best by monitoring your credit reports. You can do this with one of the three major credit reporting companies, Equifax, TransUnion, or Experian.

These credit reporting companies will provide you with your credit history as well as your credit card statements. In addition, you can read the history of your account and see any accounts that you have had outstanding and even those that were paid off.

This can help you monitor your accounts’ status and even fix any errors on your reports. Unfortunately, it is not always easy to keep your credit reports accurate, but you can do your part by using the services offered through these companies.

Many sites will give you free MyCardStatement for a limited time so that you can get all of your data for free. However, once the period ends, you will not receive a MyCardStatement.

What is Identity Theft?

Identity theft is when someone gets your personal information, such as,

- social security number

- birth date

- address

And uses it to open up accounts in your name. This will cause a lot of financial stress because you are now dealing with high interest rates, over-limit charges, and late charges. You also have to worry about the identity theft of your credit cards.

How Can Identity Theft Happen?

If you have not been paying your credit cards on time, you may have been getting multiple credit cards in your name. With this, you are putting yourself in a position to be a target for identity theft. You need to stop doing this right away and make sure that you are only paying your credit cards once a month. This is how you are going to be able to keep the identity thieves away.

Conclusion

These details will help you to understand the benefits of MyCardStatement better. Millions of users are using it for purchases and spending on other services. Make sure not to share your user details to protect yourself from scams. You can also look at Meetscoresonline.com if you are a gymnastic enthusiast who would like to learn more about the sport. Suppose you are a gymnastic enthusiast who would like to learn more about the sport.

If you are a shopaholic, you can have a look at mybalancenow and Mybalancenow.info to know how target gift cards work and how to make the most out of them.

Having a credit card is quite a responsibility, and setting up an account on the portal of MyCardStatement will only help you do better with your finances through your credit card. If you need any assistance or questions about statement inquiries, transactions in credit, credit card provider, transaction history, questions about transactions, leave a comment below.