What is so great about MyPremierCard? This card is one of the few credit cards out there that not only allows you to purchase items that can be used in your home, it also allows you to buy things at retailers online. My First Premier card allows you to make innumerable purchases online, or with any phone provider that offers such things. This way you can get a cheaper deal than if you choose to shop online or use an internet connection rather than paying a premium phone bill.

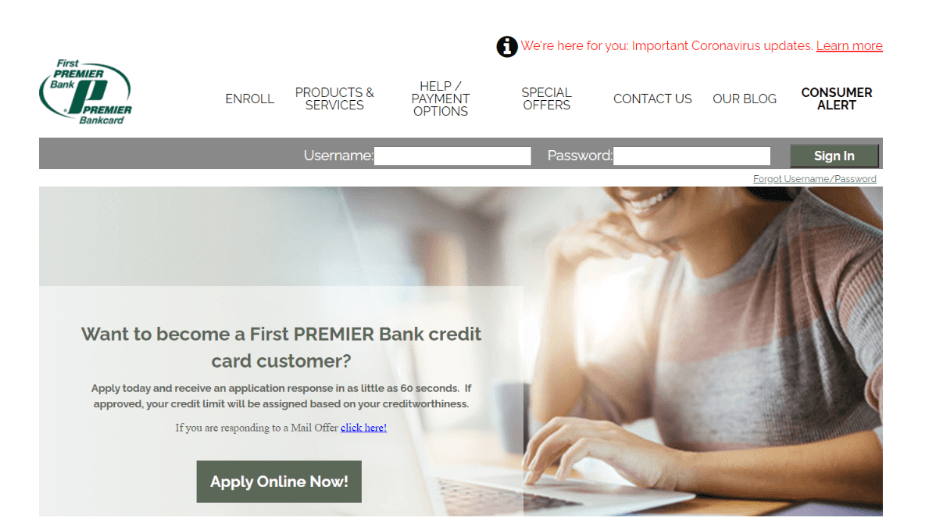

With this card, you will be able to apply for it online, with your checking account, through phone, and even on your fax machine. You may also receive an invitation in the mail. You can then select the credit card you would like to apply for and sign the application online, complete your credit card application by providing necessary information and you will be on your way to enjoying all the perks of this card.

On this page, you’ll learn about the following:

Benefits of Premier Card

The benefit of having a Premier card is that you can use your credit when you have to. The cards come with no annual fees, so you can keep track of all your spending.

- Another benefit of these credit cards is the convenience of using them online. Many credit cards are available, but none of them allow you to do everything that you can with a debit or credit card.

- You have no choice but to swipe your card when you want to pay for something or do anything that you can do online.

- With a credit card like this, it means you don’t have to worry about how much money you have left in your wallet because you can do the payment in the comfort of your own home.

Also Read mycardstatement, northshoreconnect, myprogramminglab, mynassauproperty, meetscoresonline, and other articles on this site.

Finally, you will want to think about the fees that you may be charged by most other cards. If you decide to take advantage of any of the bonuses available with these cards then you may have to pay some sort of service charge for it. These fees can be high, but if you know what they are you can try to avoid them. You can seamlessly make whatever purchase you want with this card, and not worry about having to pay extra, unnecessary charges.

More Advantages of The Premier Card

There are many advantages to having this credit card. Here are some of them:

- The first one of these advantages is that you will not have to deal with an agent who tries to sell you a credit card. If you’re already a member of a rewards program, such as Starwood Preferred Guest, you won’t have to look for additional rewards.

- The other thing is that with all of the cards out there, it’s tough to make sure that you’re getting the best rates and services. You can shop around and compare rates so that you can get the best service for your money.

- The other thing that you will love about My Premier Card is the added benefits. When you become a member of the card, you’ll get a free hotel stay, free breakfast and dinner, as well as additional perks like discounts at the stores and restaurants that you use your card at.

- You can get even more benefits by using your card at other retailers or companies that are affiliated with the card. All these benefits are there to serve the best interest of the user. No matter what, you can be assured of getting the best deals from every purchase through your Premier Card.

Also, if you have credit issues at any point in your life, you can use your credit card to get them resolved. If you need to settle a bill, the card company will work with you to reduce or eliminate the amount that you owe.

Another thing that makes My Premier Card a great card to have is the fact that you don’t have to carry a balance.

- When you purchase things from an establishment, the company will add the price of your items to your card balance, but you will never have to pay interest on the balance.

- This means that you can enjoy unlimited use of your card without worrying about making payments on time. These services truly make PremierCard stand out from the rest.

Uses of The Premier Card

As you might guess, these cards are much like regular cards – except that they will have a special name. So, instead of being just another credit card, they’ll be called “My PremierCard.”

But just because the name is unique doesn’t mean you should limit yourself to using it only for emergencies. If you have a problem or concern, you might be surprised at how many options are available to you.

- If you already have a PremierCard, you might not even realize this option. But you can make sure that you always have a credit card that works for you.

- It’s possible to open a different card if you have a question or concern. For example, if you’ve lost a wallet or purse, or have broken something, but no credit cards, you can contact the card company and see if they will give you a new one.

- If they can’t help you, they may be able to refer you to a local retailer. Most places do have emergency service centers that are open 24 hours a day.

These credit card companies may also refer you to a financial organization for help. These organizations can also help solve your other credit card problems. Some charge late fees or add on charges if you don’t pay your card on time. However, once you know your rights, you’ll be able to stop these from happening. Some credit card companies also allow you to pay off your balance in full each month. That way you can continue to maintain a good credit score.

Read more about other similar services Northshoreconnect.org/signup, Pearson.com/myprogramminglab, Nassaucountyny.gov/mynassauproperty, Meetscoresonline.com, and other articles on this site.

Difference between Premier Card and others

Some cards even allow you to apply for a card with a lower interest rate and longer grace periods. There’s a chance that if you can keep your spending down, you can even qualify for an unsecured card. Unsecured cards aren’t based on credit score.

- Credit cards can also offer amazing cashback rewards. You can also earn points for having items shipped to you, being an airline miles member, or having a membership to a hotel club.

- There are also some credit card companies who offer free membership sites where you can earn free airline tickets, etc., and get free gas vouchers.

- If you’re having trouble with payments, contact your credit card company immediately. Most of them have customer support lines.

- Some of these credit cards will charge a small monthly fee, but after a year or so, your balances will be reduced by the amount you have paid on your credit card. You can then transfer the balance from the credit card into a regular card.

- There’s also a free report on a credit report that can help you learn about your history and make changes to it. This can save you a lot of time in the future.

Conclusion

There is no annual fee or monthly balance payment with this card. With a simple activation procedure and a couple of clicks on your computer, you will have the privilege of having unlimited access to your card for the rest of your life and not have to worry about the amount that you have left out. Once you are done using your card you will simply request a refund of the balance on your account, and then you are ready to enjoy your lifestyle. Get excellent benefits and online access. Make sure to save your account from unauthorized access. You can ask us about credit limit increase, credit card login, credit card offers, flexible repayment options, savings options, additional benefits, mortgage access, credit protection, money investments, money transfer, or queries from the article in the comment box. We’ll be happy to assist you! You can also contact the customer service department of myfirstpremiercard.